“Some ski area operators described the season as a roller coaster, and I applaud those same operators for being flexible, reopening to take advantage of a late season storm or making snow in late March to squeeze in one more week,” said Kelly Pawlak, NSAA president and CEO.

Visits by ski area size ans regional impacts

Extra-large resorts tallied the bulk of skier visits at 57%. Although small ski areas account for 59% of U.S. ski areas in operation, they tallied approximately 13% of total skier visits. NSAA measures ski area size by vertical transportation feet per hour (VTF/h), a calculation of uphill lift capacity.

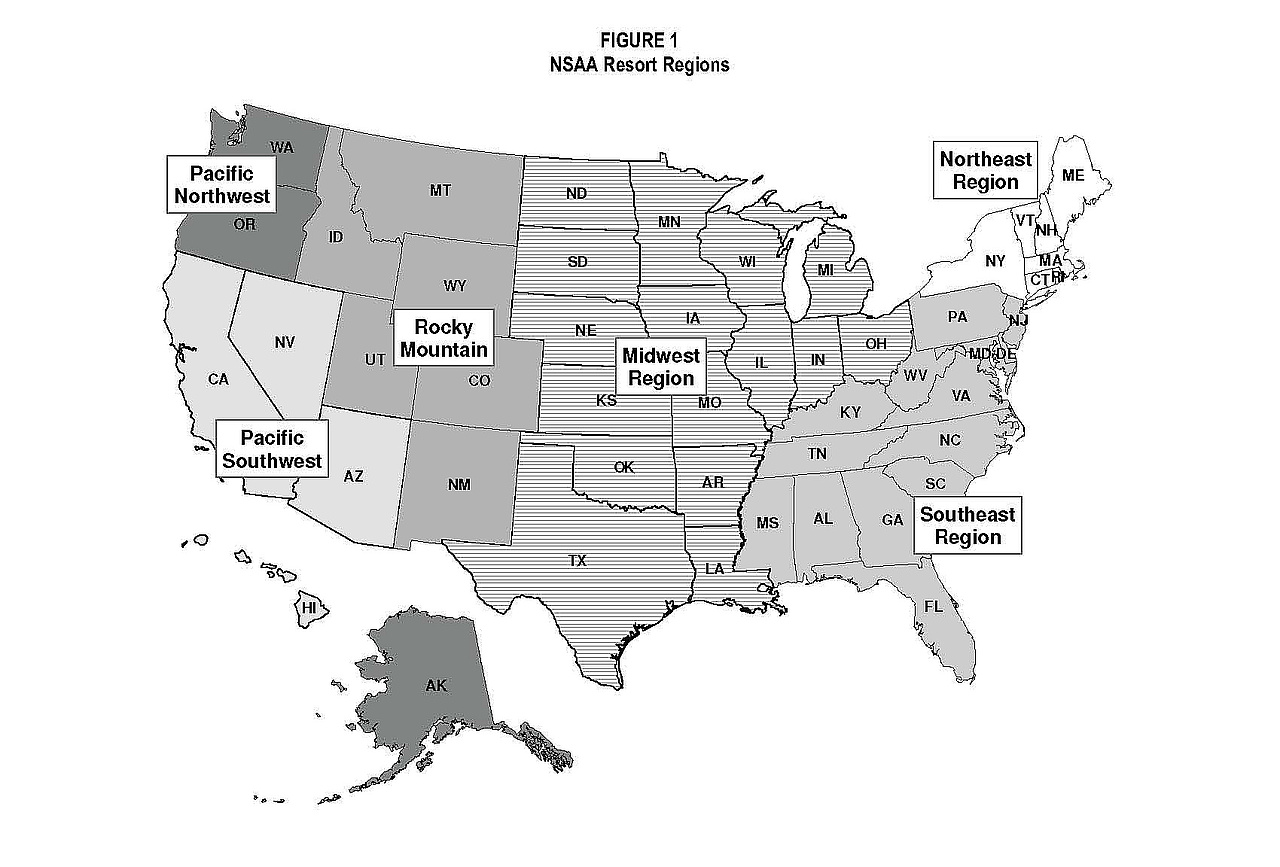

NSAA divides ski country into six regions. While performance remained strong in several regions, all six regions experienced a decline in skier visits against last season’s unparalleled numbers. The Rocky Mountain region remains the most visited, reporting 26.7 million skier visits, followed by the Northeast at 12.4 million and the Pacific Southwest at 8.0 million. The Midwest was the fourth-most visited region, tallying 4.8 million visits despite also reporting the biggest YOY decrease (26.7%). The Pacific Northwest region reported 4.2 million visits. The Southeast reported 4.2 million and had the least change year over year.

Season passes remain the primary access product used by skiers and riders for the fifth consecutive season. Season pass holders made up 50% of visits nationally, with standard day or multi-day lift tickets claiming 31% of visits. The balance is claimed by frequency products (showing a 3 ppt increase this season), off-duty employees, complimentary products, etc.

![[Translate to English:] Foto: Leitner](/fileadmin/_processed_/a/8/csm_Vertragsunterzeichnung_Narvik_6_copyright_LEITNER_print_501f2d5c24.jpg)

![[Translate to English:] (c) Doppelmayr](/fileadmin/_processed_/b/3/csm_85-ATW_Stechelberg-Muerren_Lauterbrunnen_CHE_001_6442c0520d.jpg)